What new users are asking about Bitcoin? Darth is answering them

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Originally posted on Substack on Jan 06, 2023

Updated here on Dec 17, 2024

I have been collecting the most frequent and interesting questions about Bitcoin. And to have a history, I am adding them here with the corresponding answers. I will try not to go into too much technical detail and explain / answer it with my simple words so that everyone can understand it in a logical and normal, human understandable way.

If you still can’t find answers to your questions, you can check out the Bitcoin Myths page and also this playlist of question and answer sessions about Bitcoin.

Q1 - Why do you do this? Why do you spend your time teaching people about Bitcoin? Do you have any profit or interest?

Excellent question! I want to teach people about Bitcoin for several reasons:

- I consider it my mission to do good in this world full of scammers, corruption, lies and greed

- I consider that it is my little gift or work for humanity, I make my knowledge on this subject available to everyone without any material, political, spiritual interest or of any kind my only gain from doing this is that the world can be liberated from the slavery of fucking banksters (bankster = banker + gangster). Each person who frees himself helps me free myself, it will be useless if I free myself only. Only together we can beat these motherfuckers!

- My vision is that Bitcoin is the path to ultimate Freedom, financial and individual sovereignty.

Read more: For whom is DarthCoin writing guides?

Q2 - What happens to Bitcoin if banks and governments are going to create their “cryptocurrencies” (CBDC)?

Well to begin with, these CBDC (Central Bank Digital Currency) are NOT cryptocurrencies as they want to call them, just to confuse people. They are simply the same FICTITIOUS euros and dollars, but this time more control, more surveillance, more restrictions, forcing you to use ONLY their versions of super controlled virtual wallets. In short, an even bigger deception than it was until now ...

But the question is not well proportioned. The thing is that Bitcoin is going to continue on its way quietly, it is not going to affect it with almost nothing. Bitcoin and CBDC are two totally different things. Bitcoin is sovereign, decentralized and limited currency. CBDC would be a currency of slavery, centralized and unlimited. Let's see which one are you going to choose?

On the other hand, there is a VERY IMPORTANT aspect: currently the banks are the ones that facilitate the majority of corruption, theft, traffic, B-boxes of politicians, etc. Without these banks and their corrupt system, these motherfuckers couldn't play their dirty tricks. Well, if they create a very centralized system, I don't think these corrupt people will like them, because they won't be able to make their games anymore. So we are going to see a lot of misrepresentation with these CBDCs, because there are many who do not want them or ... they are going to get into Bitcoin.

Q3 - Does opening a Bitcoin account (wallet) have any cost?

NO. NEVER. Bitcoin is free to use for any human, individual, person, company, IoT. Your BTCs are always still in the Blockchain, what you have in PROPERTY are the property keys of these BTCs. When you say that "I open an account" of BTC is not really correct, it is more to take possession of the keys of a wallet. And owning this wallet does NOT carry any cost.

Q4 - Does the stay (in Bitcoin) have any cost?

There is no "permanence" or "permanence" obligation in having BTC. Bitcoin is a PROPERTY and you are going to own it until you feel like having it, until you transfer this property to another. When you “give / send” someone some BTC it is not practically a transfer of cash or physical money, it is practically a transfer of PROPERTY.

Q5 - Does the payment transaction have a cost?

Yes. A transfer (of property) (tx) of some BTC from your wallet to another has a “cost of mining”. This means that for your tx (transaction) to be confirmed and included in a block (in the Blockchain), the miners have to do a super complicated mathematical process, which is going to pack this tx in a safe and IRREVERSIBLE shield. This work costs a lot of energy consumed by the miners and for this it is paid, depending on the size of the tx (in bytes) and the status of the Bitcoin network at the time of the tx (mempool). Example: if you are in a hurry to push a tx that is confirmed by the miners faster, you have to set the fee (mining commission) higher, according to the cost at the time (see mempool). If you are not in a hurry, it is a normal tx that can arrive confirmed later, because you can put the lower fee.

You can see more details, calculations and graphics about this in this collection of Tools page, about mempools, Fee rates etc.

Q6 - Are many merchants accepting Bitcoin?

Yes, in the last years, there was an explosion of number of merchants accepting Bitcoin.

Here you have some lists with many resources:

- Paying bills with Bitcoin

- P2P marketplaces with Bitcoin

- List of merchants accepting BTC/LN

- Bitcoin merchants live payment examples

Q7 - Where does the money go from the acquisition of bitcoins by the different users?

If you mean “fiat” money (€uros/USD), it becomes sovereign money (BTC). But if you mean like an account, Bitcoin is not like that, it is not like a normal bank account, because it is proprietary and is a totally separate system from the fiat banking system. When you "exchange" euro for BTC, it is practically that you send a bank transfer (if you make the change through an exchange) to the seller, normal and current; and the seller on the other hand, in another system (the BTC Blockchain) makes a transfer of ownership of their BTC to your BTC keys. But this is not really necessary, it is just a beginning, when you start and you do not have a way to EARN the BTC. You can also sell your products / services directly for BTC or on a website or physical store and your customers pay you in BTC. This is the best way to get BTC. There are more methods of obtaining them and you can consult them on this dedicated page.

Q8 - If it was not created for speculative purposes, why is Bitcoin being speculated?

There is speculation about everything, even potatoes or legumes. To speculate means "to find a price." It is not negative in itself, but governments want to give this term a negative connotation so that you do not speculate and they and their friends do it, stealing your sovereignty. Scarcity is a reality. Everything has a limit, and the only way that something can be used as a medium of exchange is if it is scarce, like gold. But also anything else. You buy potatoes or oranges because they are scarce, you cannot find them on the street, and they require a job that is scarce. All of that must be paid for. You can never subsist on free. Nature itself demands work, and resources are always scarce.

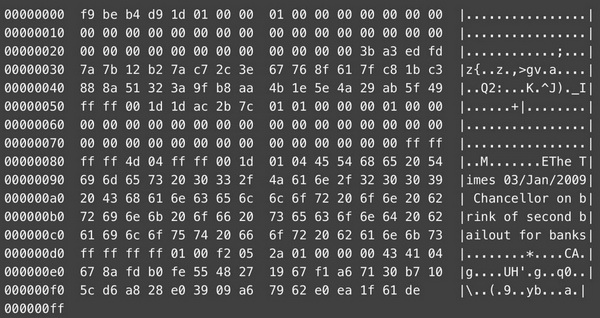

Bitcoin was created in 2008 in the middle of the crisis, EXACTLY because the creator was fed up with so much speculation and theft in the financial market, and has decided to create a currency and a financial system different from everything that was used until then. Satoshi Nakamoto has taken the power to create and control money from the hands of the bankers and has given it to the people, to the people. It has even published within the first mined block, the same message that in the press then spoke about the bailouts of the banks, as a warning and tease to all bankers.

Here you can see the encrypted message of the first Bitcoin block,

and here the newspaper of the same day that said about the bailouts.

This is a HISTORICAL MOMENT FOR HUMANITY!

Q9 - Why only put 21M bitcoins on the market? Doesn’t that encourage speculation?

It is purposely limited to 21M to make it SCARCE. The scarce things have more value than the not scarce.

Read more - Bitcoin is digital scarcity - by derGigi

Q10 - How does Bitcoin differ from other “cryptos”?

Bitcoin is the first and only decentralized currency. The rest are substitutes created for people to pick and invest in them, their authors making a lot of money from it. It uses only Bitcoin, the remains we call it SHITCOINS and it is not for nothing ...

Read more:

Q11 - Are there methods to lend BTC? If I have 1 BTC and a house is worth 10 BTC, in the end someone will have to make me a loan anyway, right?

This is a special chapter in Bitcoin economy. There’s a lot of controversy about these practices. And all comes from GREED.

Here you have a very good explanation of how this financial market DeFi works, to have a good view about the mechanism.

But let’s dive a bit more into this aspect and see what Bitcoin can do, or is trying to do.

Greed is a characteristic of human behavior that could not be eradicated, but at least controlled at a low level. Each wo/man have a desire and attraction to “have more”, it is in our genes to desire more even if we can’t afford it with what we have or can do. And this come from long time ago, from the deep human history. But in the last century it was accelerated and even became a “religion”. People will do whatever they can to get more stuff, even no-necessity/util stuff, just hoarding so others don’t. and this greed was creating a huge system of lending/borrowing of money that people do not have and even cannot create, perpetuating a forever debt. Practically we are living in a debt slavery world. People are buying all kind of stuff, with money that they do not have it.

Bitcoin come to fix this paradigm. You cannot spend more bitcoins than you have in your own control. It cannot be created more than 21 Millions. FOREVER.

So what “smart guys” are doing now? EXACTLY what banksters did in the 17th century: offering to those gold owners, a place to deposit their valuable gold coins, into a bank vault, in exchange for a piece of paper, an IOU of x amount of gold. Now they are offering digital platforms for Bitcoin owners, to lend their BTC for a % of interest. But nobody ask: “from where is coming this %of BTC interest, if will not be created more BTC?”.

To sustain this aspect, please watch these two amazing videos (one is a Spanish movie about a guy that won the lottery and one is an animated documentary about debt). Both documentaries are a must watch.

- Concursante – Spanish movie (EN subs), with a guy that won the lottery but he entered into total debt, just because of the evil system.

- The American Dream – animated documetary about how the american dream is actually a debt nightmare.

So yes, we’ve already seeing these “greed platforms” that are pushing back people to the debt system: Ledn, Blockfi, Nexo, Celsius, Lend Hodl etc. And all died, eating their own vomit.

These platforms are not doing anything different than the old banksters of 17th century: are taking users BTC as collateral and lend to others shitcoins. Later they sell the shitcoins (or even fractional reserves) for BTC to pay the interest to the BTC lenders. But this creates a huge pressure into creating even more shitcoins out of thin air. And the system will perpetuate until will collapse, exactly like the actual fiat system.

Michael Saylor say it very clear: he will buy all bitcoins available, will HODL them and later will lend them as collateral to all poor guys that today do not want Bitcoin. In plain sight you have the banksters and billionaires plan: to enslave you again in debt. If you still do not understand that, means that humanity deserve to be forever enslaved by few…

Also another aspect is that these platforms usually end up in scams/hacks/lost funds. Owners greed is so powerful that in the end will make them run with all the money. Happened many times in the past, it will happen again. Why? Because people are dumb and trust these platforms and give them their BTC. Simple as NOT YOUR KEYS = NOT YOUR BITCOINS.

Satoshi created Bitcoin EXACTLY to avoid all these practices and make people think and start SAVING MONEY for later, instead of borrowing more than they can afford. Many will say that this is against advancing in tehnology and building more new stuff. But I am coming and ask: what are you need for your daily life, basics, to live a simple and healthy life? The answer is simple: energy, food, shelter. So why are we not concentrated into that only?

Why do we need 2-3 cars/ family, why do we need 2-3 houses /family, why do we need 2-3 phones/individual, why do we need to buy stuff and food that we really don’t need it and so on…? We are living in a world full of unnecessary stuff, just for the sake of consumerism.

Bitcoin is changing the mentality of consumerism into mentality of savings. Save today for having tomorrow enough to buy the stuff you really need it. Don’t stretch you legs more than the duvet.

Bitcoin WILL PUMP FOREVER in value! No need for anything else than just HODL and use it when you need it most. More you HODL = more value will have in the future. Do not sell your BTC to billionaires! Is the only way to keep them away!

If you want to risk your money (and is a huge risk in this) for just few % of fake interest (based on fractional reserve), is up to you, but at least I did what I can and warned you about this.

In order to give you more details about these aspects, here you have both sides supporting one or another way. You are the only one that have to choose for yourself. But before that, be very well informed in this matter.

- Bitcoin Peer to Peer Decentralized Lending w/ Max Keidun from Hodl Hodl

- Bitcoin and fiat debt – Saifedean Ammous podcast

Q12 - If there is no internet connection or you are in a place without coverage, how can you use Bitcoin? Or if a government has to shut down the internet access? Wouldn’t it be a danger that we lose our BTC?

There are many options to use Bitcoin WITHOUT an internet connection. Recently there have been tests with radio devices such as GoTenna or using antennas and equipment with connection to satellites and using the satellite network. In Sep 2020 a group of bitcoiners in Venezuela, Cryptobuyers, have connected a BTC node to the satellite network. Here is a guidehow to run a BTC node to the satellite network.

here is also the possibility of sending by SMS, the tx is created / built in an offline wallet, and the result in the form of an encrypted text code can be sent to a friend or relative by SMS, who simply broadcasts to the tx, copying the code in your wallet and giving you send. He will never have access to his wallet, he just re-transmits the tx.

A government is NOT going to close access to the internet because they too depend 100% on this internet. Yes, they can restrict it, but nowadays, some computers interconnected in some way by a network, can already use many versions of the Internet that cannot be censored (see TOR). But the question is: if you live in a country where the government is an oppressor, it wouldn't be more logical to ask "why did we leave our government that enslaves us?" The problem is NOT in Bitcoin, it is in our government and in us because we let it do this. We do not forget the saying: “When people fear their government, there is tyranny; When the government fears the people, there is freedom". If you are already in a tyranny, then your concern is not how to use BTC, if not, how to stop this tyranny.

Tools: BitSMS and Inmarsat IsatPhone and Samourai wallet

Q13 - What happens to Bitcoin if there is a power outage or a world war?

Your BTC would be very good on the blockchain, you would never lose it (as long as you still have your access recovery keys). I personally would not ask myself this in case of a global power outage or war… I would first worry if I have supplies of water, food, defense, security for a longer time. There are many more "threats" in such apocalyptic cases (nuclear bombs, terrorist attacks, military attacks, "zombie" attacks that were not prepared etc).

Q14 - What is a HODL-er?

By 2013, when Bitcoin was experiencing large price drops, BitcoinTalk user GameKyuubi wrote a thread that began with the following expression: "I AM HODLING." In the thread, he made reference to that he would keep his bitcoins and would not sell them even if the price continued to fall. In his message, he explained to the community the reason for his decision, also acknowledging that he had made a writing error. Writing the word HODL instead of HOLD, which translated into Spanish, means to keep or conserve.

Almost instantaneously, memes of all kinds began to appear that made reference to the words of this user. Adopting the expression "Hold on for dear life" as a phrase typical of Bitcoin investors, who would maintain possession of their coins at all costs.

The word HODL (from the English HOLD, but misspelled) is very frequent among users and investors of cryptocurrencies, mainly Bitcoin. And it refers, specifically, to the firm decision to acquire an asset and keep it over time. In Bitcoin, this decision is seen as an investment philosophy, which allows users to exponentially multiply their assets in the near future. Normally HODLers are Bitcoin maximalists who always buy BTC anyway, but NEVER sell them for fiat currencies. They wait for the right moment to use them as ordinary money.

Q15 - Will I make money from mining (2023) ?

When people start their bitcoin adventure they often go through a little gold rush with the concept of mining (I'd know, that's how I started;)). Here's a little guide to answer your perennial question "will I make money from it?":

Let's talk about hardware first (click the link for a long and useful list). You won't make money mining bitcoins unless you have a really high ATI GPU, FPGA, or ASIC. That is the short answer. Having a decent CPU can be used for Litecoin mining, which can be a small income in itself, but we are here to talk about Bitcoin.

To see if you will earn any money, you need to enter some data into a special calculator:

- cost of your hardware (cost of buying an ASIC, GPU, motherboards, power supplies, etc.)

- how fast it can hash (mega hashes per second). This can be obtained from your hardware list

- how much power it consumes (again, hardware list)

- your electricity cost (check with your power company)

And then there are two magic variables that will make everything work or are doomed to failure:

- Difficulty: The calculator completes it automatically, but for long-term mining (more than a few weeks), you must be a pessimist. Multiply the value by 10 for predictions for a few months or 100 for a year or two (it will increase considerably soon)

- The price of bitcoin, which is also filled by the calculator, could go up or down in the future, affecting your bottom line. It will probably increase in the long run, but let's be pessimistic and lower that to $ 10- $ 20 to make sure we are making money no matter what.

Having all your hard data and your guess about the last two variables, you put everything into the mining calculator and see what you get. You will get your earnings in BTC and dollars, as well as a summary of your costs and when you will even brake, and what your net income will be during your investment period.

You most likely won't make money from mining Bitcoin, and that's okay - mining has become a very specialized process. If you want to invest money in new ASICs, you may be able to make a considerable profit.

TLDR: use this to verify everything. ASICs Can Make You Money, GPUs No Longer

Nevertheless here are some good resources about mining bitcoin at home if you want to heat your house:

- Braiins – Mining profitability

- Mining Pool stats

- Mining Costs Analysis

- Mining for the streets

- Home mining for non-KYC BTC

- Mining BTC in an apartment

- HeatBit – Home heater that mine Bitcoin

- Red Dirt Open Source Mining Calculator

- Methane power calculator for mining

Q16 - If someone knows the 12/24 words of your mnemonic phrase but not the order, how long would it take to force it and steal your coins?

Well, some quick math to get an idea. Suppose we can check an order once per clock cycle on a 5ghz cpu core. 24! Orders / (5 * 109) Orders per second = 1.24 * 1014 seconds.

1.24 * 1014/60/60/24/365 = 3,934,858 years approximately.

That's assuming a single-core CPU in a computer, but that's still really high. I'm also assuming an order per clock cycle, which is also an understatement, it would actually take a lot of clock cycles.

Q17 - Is it OK to spend my bitcoins for my regular groceries / spending?

First: Bitcoin is hard money, and to understand this term I recommend you to read Saifeadean Ammous's book "The Bitcoin Standard".

Second: Bitcoin is a deflationary currency, not inflationary like the fiat currency (euro, dollar). This means that over time the purchase value grows, so it pushes the user to save Bitcoin and not spend it on any useless stuff. You keep it to yourself to spend it at the right time and on things you really need.

So if you still have fiat currency, it is advisable to spend it first, which is the weakest currency.

An example: You have a monthly general income of € 1,000. You still receive it by bank account.

You have food expenses of € 200 / month, rent € 200 / month, several € 100 / month, utilities € 200 / month. You keep € 300. Well, you exchange this € 300 for BTC and you keep it there, for later. If you already know what expenses you have more or less each month, then you save this sum in euros and throw it away as necessary to spend. In case if your expenses go up in a month, because since you don't have more euros, you start using BTC.

But be careful! Better only in stores that accept direct BTC or at least with Bitrefill.com (recharge cards). Why not sell them in exchange (market)? Well, because if you don't put it on an exchange, don't create liquidity, don't create selling pressure, don't create pressure to lower the price. Remember: the more people want to sell, the price goes down. You don't want the price to drop. If you buy from a merchant with BTC, this merchant may NOT sell their BTC, just as it does not create selling pressure.

In short, when should you spend your BTC? Always when you have no more euros, when you want to help a merchant to receive BTC, when you want to try purchases with BTC, when there is no other payment option, when you do not want to know that you have bought, when you buy from another country / currency.

This is how the circular economy of Bitcoin is created.

Q18 - Do you think it’s wise move to transfer the majority of my savings into a BTC HODL wallet?

Short answer

If you think of your savings for short term (few months) - NO.

If you think of your savings for long term - YES.

Long answer

Forget about "keeping money in a bank". That term will not be viable anymore and we were warning from long time ago about this. In this world, from now on, it will be two types of digital currencies:

- One that will be created/controlled by the Central Banks/BIS, unlimited supply (endless inflation) and used mainly to enslave the world, to use it as draconian surveillance system, the so called CBDC (Central Bank Digital Currencies).

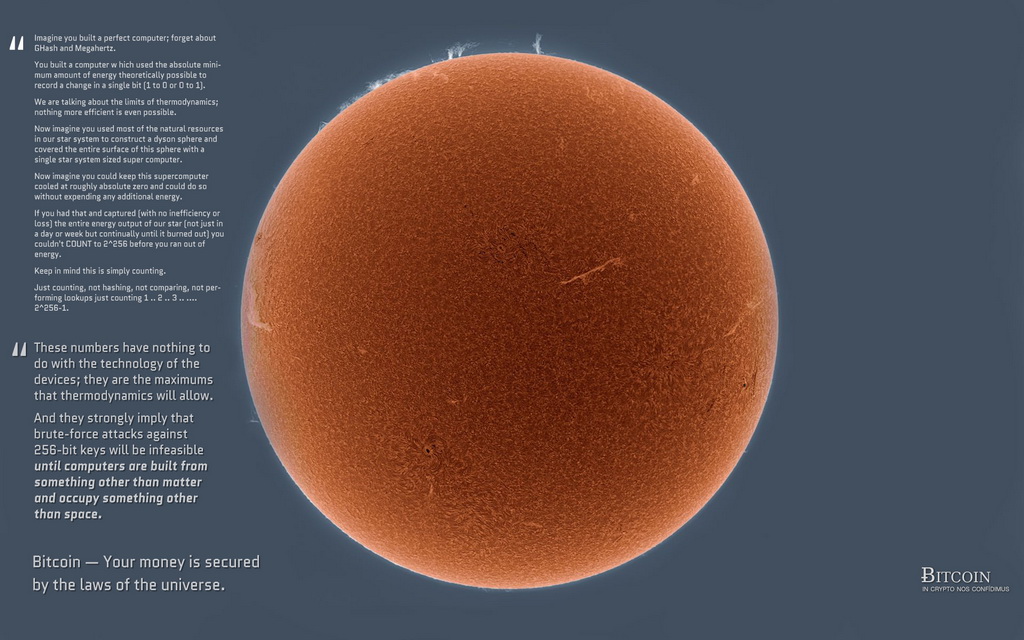

- One that is DECENTRALIZED and controlled by the people, by each user, that cannot be seized, cannot be traced, is borderless, open source, unconfiscatable and LIMITED to 21 millions. This is Bitcoin the true cryptocurrency, the most secure system in the world (see Q16). A truly sovereign currency.

Now I will ask you: In which system you want to live ?

I choose to EXIT from the Banking Cartel, I choose Bitcoin, because is FREEDOM