It's a long way to the top, if you wanna Rock'N'Roll !

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Originally posted on Substack on Jan 31, 2024

Updated here Apr 21, 2025

A practical guide how to climb the ladder of BTC LN wallets for new Bitcoin users

This is the story of a baby user, starting his journey into Bitcoinlandia, trying to stack sats, one by one, from many different sources.

The use of each wallet app from above image is not mandatory; is just a representation of the level of complexity of each app and their functionalities.

In this guide I will explain the steps and which apps a total noob should use, in order to have a smooth journey into climbing the Bitcoin knowledge ladder.

Usually, a new Bitcoin user should start by learning the basics of Bitcoin, how onchain transactions work, how Bitcoin blocks are mined / confirmed and the most important: SELF CUSTODY IN YOUR OWN BTC WALLETS. Let’s consider you already learned these basics but right now is hard for you, as a new user with limited funds, to stack straight in onchain wallets.

Let’s consider this use case for a new user that is not a Michael Saylor to buy in chunks of thousands of BTC, but a regular user trying to stack sats, slowly, one by one, from many different sources, and cannot jump straight into onchain wallets, due to high fees and want to stack larger UTXOs (coins) in his HODL onchain wallets.

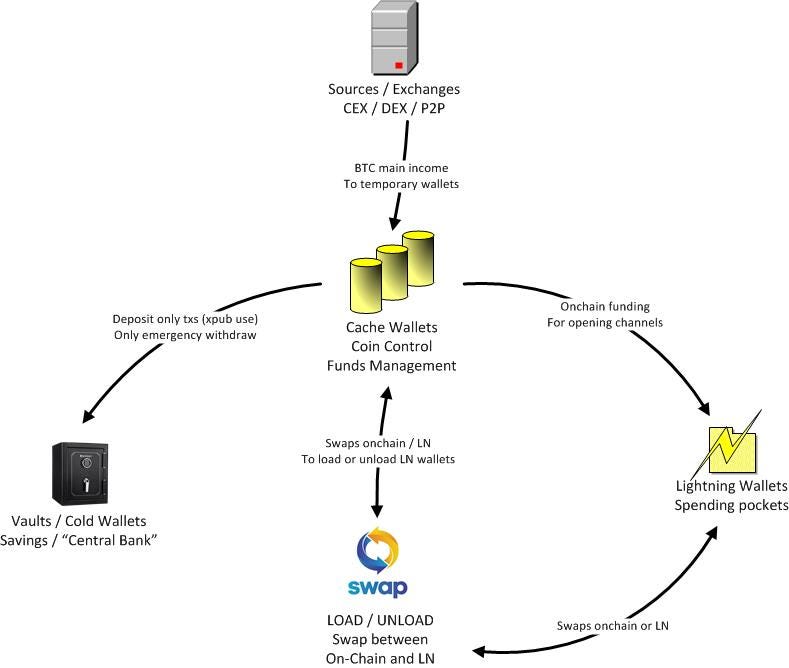

As I described in the previous guide “Be Your Own Bank - Think Like A Bank” is better to stack your BTC stash on 3 levels: HODL, CACHE, SPEND (LN). To reach that HODL level a new user must pass through spend (LN), then cache (swaps) and then to HODL (onchain vaults).

Another must read guide and have it bookmarked is “Lightning Wallets Comparison”, where as a new user you could find more technical description and functionalities of each LN wallet app described in this article.

Bitcoin Layer 2 (Lightning Network - LN): is an accounting system which lets you transact with a L1 (onchain) asset independent of the native L1 accounting system.

STEP 1 - STACKING SATS

Let’s consider that you just want to start by receiving some tips, few sats, over Lightning Network (LN), donations, small gigs paid in sats, zaps from NOSTR, doing various tasks rewarded with sats. All these small amounts are almost impossible or very costly in fees if you try to do it over onchain transactions (txs).

Even buying sats with the DCA method, every week, small amounts, from exchanges that support LN withdrawal, using the LN level as a base is much better than stacking straight into onchain wallets.

Another important aspect is that stacking on LN could offer a good level of privacy, because you can consolidate larger amounts and then send them through a swap service to your onchain vaults. Even non-KYC but custodial LN accounts could be used very well as decoy temporary stacking level until you accumulate a certain amount of sats to be moved to your own onchain wallets, in full self custody.

If you are small merchant, I recommend reading this other guide about how to operate receiving through LN.

For this 1st level, I would suggest the following process:

- receive through LN invoices or LNURL or Lighting Address small amounts of sats

- stack up to 100k sats or whatever other higher amount you are comfortable with and once you reach that limit, send the sats over LN to a submarine swap service.

- From that submarine swap service, use your own onchain wallets as destination. Each swap of 100-200-300-500k sats with his own new BTC address, creating multiple UTXOs with a certain amount. Do not use exactly rounded amounts, better to have some randomness. I suggest to use a cache level onchain wallet(s) as destination for these swaps. Not directly to your onchain “vaults”, cold wallets (see step 2).

- Some custodial LN accounts apps have integrated swaps (LN←→ onchain) so depending on their fees structure you can use them directly.

- Do NOT keep too much sats in these custodial accounts! Some of them are even limiting your total stash and withdrawal amount, but is better to move out once you are close to that limit. These custodial accounts are just temporary and could lose access to them anytime.

- These custodial accounts are also good if you use to get sats from Robosats or any other service using “hold invoices”. Hold invoices could trigger force closures of your LN channels if they get in the path some shity LN node that cannot handle very well a pending HTLC.

Wallet apps (custodial) that can be used for this 1st level, just to receive few sats without hassle:

I recommend to use as many as you can/like and spread your income through multiple sources, each one could be used better or not for specific situations.

- Alby - Webpage | Github | Blog | Telegram (include swaps and can be used as web browser extension, web wallet, PWA or imported into Zeus or Bluewallet as a LNDHUB account). Here I wrote a dedicated guide about Alby Hub, a self-custodial way to use Alby.

- CoinOS - Webpage | Github (web wallet, POS, integrated swaps)

- Walletano - Webpage | Github | Telegram (web wallet, PWA, multiple accounts) | DC guide

- Sats.Mobi - Telegram (Telegram LN bot, can be used imported as LNDHUB acc into Zeus or Bluewallet)

- Blink - Webpage | Github (light KYC, integrated swaps, web PoS/ donation page). Here is a nice guide how to use Blink, by Natalia.

- LN Voltz - Webpage (Brazilian LNBits Community Bank, with full features)

- La Wallet - Webpage (Argentinian Community LN Bank)

- LNwallet App - Webpage Instantly create a new wallet that you can use in any NWC-powered app

- Wallet of Satoshi - Webpage (require Google Services, PoS, integrated swaps)

- Rizful - Webpage | DC Guide | Very easy to start your own LN node in the cloud

- CashApp - Webpage (require Google Services, light KYC, integrated swaps)

- Strike - Webpage (require Google Services, full KYC, integrated swaps)

- Zebedee - Webpage (require Google Services, light KYC)

- Minibits - Webpage (non-KYC, ecash cashu mint, multiple mints supported, NWC)

- Cashu.me - Webpage (non-KYC, web app, ecash cashu mint, multiple mints supported, swaps, NWC)

Lightning Services for this 1st level of stacking:

- NWC dev page (Nostr Wallet Connect) applications that make it easy for a noob to start accepting sats instantly

- Exchanges and services from where you could buy sats and withdraw over LN

- Submarine Swap Services and a comparison table of fees here.

Example how to start stacking easy:

- Create an account (yes is custodial...) on any of the mentioned above apps/services, that support NWC (see https://nwc.dev/), for example the https://lnwallet.app/ is the simplest one, no KYC.

- Use Alby Go or Zeus or BitBanana to connect through NWC to that account

- Start accumulating sats into that account

- Once you reached let's say 10-20-50k sats, go and buy an inbound LSP LN channel. Here is a list of the most used LSPs.

- For example, we suppose you use Zeus (one of the most complete mobile wallet apps with various connection types), stacking sats in a NWC account and now you want to start opening a LN channel.

- Add a new embedded LND node in Zeus and please read first this "Getting started with Zeus" guide.

- Let Zeus to fully sync and put Zeus in "Persistent mode" so the LND service will run in the background. Then hit the button in the "Channels" screen, to "buy inbound channel". Select 500k or better 1M sats channel and hit create order. You will be prompted to pay a LN invoice (the lease of the channel). Copy the invoice code.

- Go to "Nodes" (top right icon) and select your NWC account. Then pay (paste) that LN invoice to the LSP.

- Go back to Zeus embedded node and you will see the invoice paid and the channel opening in few momemnts.

- Done! Now you are ready to receive directly into self-custody LN channel, with your own LN node on your mobile.

- Once you fill up that channel, use a swap service (if Zeus is nto already integrated the swap service in app) to move like 90% of your channel balance into a "cache level wallet" (see next chapter), where you will build a nice UTXO for cold storage.

- Once the LN channel is (almost) emptied (never move all the funds, leave like 1-5%) you are ready to repeat the processs.

STEP 2 - CACHING YOUR 1ST LEVEL OF STACK

At this level you are stacking big chunks of sats in your own custody onchain wallets.

Use multiple onchain wallets, with multiple UTXOs, multiple BTC addresses, receiving from swaps, as intermediary step, until you pile up larger amounts for your long term vaults, opening LN channels and simply caching your stash organizing your UTXOs. This is the level where you must learn how to be your bank and think like a bank.

Recommended actions for this 2nd level:

- Use desktop wallet apps, for better management of the BTC addresses and UTXOs. Bitcoin ONLY! And use a Linux OS, dedicated for this task.

- You can use mobile apps for watch-only wallets, in case you are on-the-go and you need quick access to deposit onchain. Read here a guide about watch-only.

- Use an offline password manager to keep safe and a good track of all your wallets backups. KeePass and Bitwarden are very good for this and are multi-platform.

- Organize very well all your UTXOs, label them, consolidate and coinjoin them if you want more privacy. Sparrow, Electrum and Wasabi are very good desktop apps for this task.

- small UTXOs of 100-500k or even 1M sats for opening future LN channels.

- Medium UTXOs of 1-2-3M sats for quick use in case is necessary and do not want to split a bigger UTXO in the future.

- Large UTXOs of 3-10M sats to be stacked into onchain vaults for medium holding time.

- Big UTXOs of 10-50M sats to be stacked into onchain vaults for long term holding, UTXOs that you are not planning to move in long time.

- Huge UTXO of 1BTC, in extreme cases as inheritance plans.

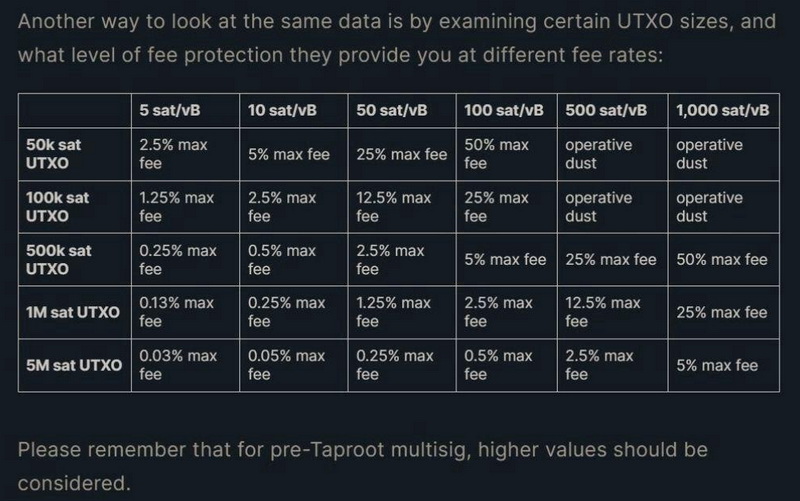

- Prepare and calculate very well your moves, depending on the mempool fees in that period. PATIENCE IS KEY IN BITCOIN! Read and learn more about how mempool fees works.

- From this level, you split your stash into 3 parts:

- HODL - send to your onchain vaults, cold wallets, long time holding wallets.

- LN channels - open LN channels if you start using your own LN nodes (public or private). Read here a liquidity guide and a guide about private LN nodes.

- Cache - keep some UTXO into this 2nd level for future need, so you don’t need to take back from your long term vaults.

Wallet apps that can be used for this intermediary 2nd level:

I recommend to use as many as you can/like and spread your income through multiple sources, each one could be used better or not for specific situations.

- Electrum - Webpage | Github | Docs (desktop and mobile wallet with integrated swaps and LN channels management, very good for UTXO management)

- Sparrow - Webpage | Github | Docs (desktop onchain wallet with integrated coinjoin, very good for UTXO management)

- Wasabi - Webpage | Github | Docs (desktop onchain wallet with integrated coinjoin, UTXO management)

- Nunchuck - Multi-platform onchain only wallet, privacy and security focused.

- Bluewallet - Webpage | Github | Telegram (can be used as mobile watch-only and also with LNDHUB accounts)

- Green - Webpage | Github | Docs (can be used as watch-only, hardware wallets interface and also as LN wallet). Read here a getting started guide.

- Phoenix - Webpage | Github (LN wallet with integrated swaps to onchain)

- Breez - Webpage | Github | Telegram (LN wallet with integrated swaps)

- BitKit - Webpage | GitHub | Telegram - BETA phase only for testing!

- LNbits - Webpage | Github | Docs (powerful suite of LN apps and wallets, can be used in a custodial mode from an “uncle Jim” node or you run your own instance).

- Bitcoin Core - Desktop onchain only wallet for the Bitcoin node.

STEP 3 - YOUR JOURNEY IS GETTING EXCITED

At this level, you already stacked a good amount of sats in multiple UTXOs. You already feel the rhythm of the famous AC/DC song “It’s a long way to the top, if you wanna Rock’N’Roll”.

Also is supposed that you already read and learned more about how LN works, how to run a node, how to manage channels and liquidity. This is a serious level, that suppose you have enough knowledge and you are using with responsibility your own funds. Being your own bank (at serious level) comes with great responsibility. You will realize the level of responsibility when you have enough knowledge about what you are going to do. This is the level of financial sovereignty, where you are the only one that decide for your own funds, how to be used and where.

At this level you can choose the path you want to take using Bitcoin:

- PUBLIC LN nodes - a desktop node that can do LN routing, with public channels, large liquidity and maintenance, high availability and responsibility for the network. Read here about what software can be used as public nodes.

- PRIVATE LN nodes - mostly mobile nodes that CANNOT do LN routing, just your own payments, through LSP, with private channels. No need for high availability online, only in the moment of the payment.

- Or run both types if you want to experiment and learn more. But be aware of the requirements and responsibilities for each case.

Recommended actions for this 3rd level:

- If you run a PUBLIC LN routing node, calculate very well the funds you are going to use as public liquidity. This is a very serious task and require large amount of funds to be put into public LN channels. As I explained in this detailed guide about LN liquidity. Also here about how to manage the fees for routing.

- The public LN nodes cold be also used for swaps, but in some cases could reveal your identity (if you link a real one with your node). You can use decoy nodes too, as I described in this guide. More guides about LN privacy: here and here.

- If you just want to use Bitcoin for your regular shopping, over LN, running PRIVATE LN nodes is more than enough. Here is a detailed guide. Just open a bunch of small/medium LN channels with these mobile LN nodes and you will have enough to spend. Once these channels are almost depleted, refill them using any swap service, depositing from your onchain cache wallets. Spend and refill.

- With private LN nodes, you do not have to worry too much about liquidity in your channels, peers etc. Connecting to few good LSPs will provide you good routes and fees and also additional level of privacy (see wrapped invoices). Your only worry should be to refill the channels when are about to be empty.

- Make regular LN channels backups! Each time you open or close a LN channel, MAKE A BACKUP ! Save those backup files into your password manager or online (encrypted). Keep in mind, these channel backups (SCB) are usable ONLY with the wallet seed. Just the wallet seed or SCB file are NOT enough to recover your lost wallet node funds. The seed can be used for recovery ONLY if you do not have channels open anymore.

Wallet apps that can be used for this 3rd level:

I recommend to use as many as you can/like and spread your income through multiple sources, each one could be used better or not for specific situations.

- Blixt Wallet - Webpage | Github | Docs | Telegram (Full LND node)

- Zeus - Webpage | Github | Docs | Telegram (can be used in multiple modes: Full LND node, LNDHUB accounts, remote node management)

- Alby - Webpage | Github | Blog | Telegram (include swaps and can be used as web browser extension, web wallet, PWA or imported into Zeus or Bluewallet as a LNDHUB account)

- ShockWallet - Webpage | Github (BETA phase, LND remote connections, accounts)

- BitKit - Webpage | GitHub | Telegram (BETA phase, LDK node)

- BitBanana (forked Zap) - Github (remote LND node management)

- Hexa (BitcoinTribe) - Webpage | Github | Telegram (remote LND node management)

- Fully Noded - Webpage | Github (remote LN node management)

- Clams - Webpage | Github | App | Docs (remote CLN node management)

- LNbits - Webpage | Github | Docs (powerful suite of LN apps and wallets, can be used in a custodial mode from an “uncle Jim” node or you run your own instance)

- BTCPay Server - Webpage | Github | Docs (powerful suite of merchants/shops)

- RTL Ride The Lightning - Webpage | Github (remote LN node management)

- Thunderhub - Webpage | Github | Telegram (remote LN node management)

Each of these apps have specific features and functionalities. Choose wisely the apps for your own use case, but in the same time I would recommend to use at least 2-3 of them, spreading your liquidity in multiple sources.

Additional guides I wrote about some of these apps:

- Private Lightning Nodes

- Getting started with Blixt Wallet

- Getting started with Zeus LN node

- Getting started with Green Wallet Lightning

- Getting started with Alby Hub

- Getting started with Walletano

- Blixt Dunder LSP and Lightning Box Provider

- Bluewallet funding sources

- Getting started with LNbits

- LNbits for small merchants

- The bank of LNbits

- Getting started with Lightning Address

- Private banks over the Lightning Network

- Getting started with Umbrel node

- LND node SHTF scenario - ways to recover your dead node

- Migrate your old Electrum to Sparrow

- Migrate old legacy addresses to Taproot addresses

- Lightning Node Maintenenace

- What mobile device a bitcoiner should use

CONCLUSION

As you can see, as a new Bitcoin user, the journey is not that easy, there are some steps to follow, learning all the way up about how to use specific apps with specific features, in specific moments.

There’s no such thing as “the best Bitcoin wallet” that could have all available features and provide the best experience for all use cases. Learn how to use multiple apps and manage your funds like a pro, like a real bank.

The most important thing is to understand how to split your stash in those 3 levels: HODL, CACHE, SPEND. Like that you will have a smooth experience using Bitcoin and a minimal level of fees paid in future spending, keeping also a good level of privacy and security.

This article is just a simple resume from many other guides I wrote in the past, trying to put in a simple perspective the steps that should follow a new Bitcoin user. I suggest to read all my previous guides, starting with the ones listed as “additional” in this article.

Exactly about these scenarios I was talking in this Podcast episode with Lunaticoin (in Spanish), analyzing each step a beginner will take using Bitcoin.